Woman says, ‘I became a millionaire at 27,’ and she explains why money advice from your parents and ‘gurus’ is keeping you poor

woman-says-i-became-a-millionaire-at-27-and-she-explains-why-money-advice-from-your-parents-and-gurus-is-keeping-you-poor

#Woman #millionaire #explains #money #advice #parents #gurus #keeping #poor,

SINGAPORE: If you’re a young Singaporean still wondering why you’re broke even after skipping your tasty S$6 oat milk with matcha latte and surviving only on cai png with just one veg, you’re not alone. Turns out, some of the most repeated personal finance advice we’ve been force-fed might just be what’s keeping us poor — or at least, not rich.

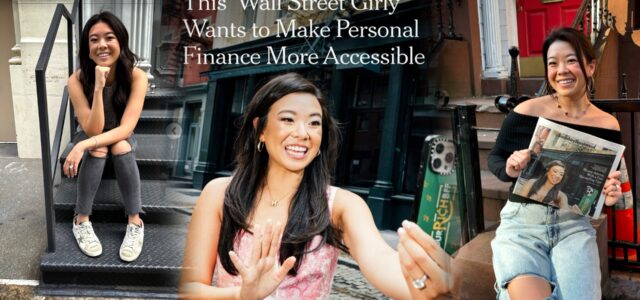

Vivian Tu — a former Wall Street trader, author of Rich AF, and founder of Your Rich BFF — became a millionaire at just 27, and now, she’s telling us to toss out those old-hat “boomer finance tips” once and for all.

In her brutally honest and relatable piece on CNBC Make It, Tu doesn’t just call out those outdated money myths — she drags them, flips them, and buries them in the cemetery of useless advice.

Here’s what she says needs to die — and why Singaporeans should also stop blindly following such financial clichés:

💼 Cliché #1: “Just switch careers to make more money!”

Sure, just hop from teaching to TikTok stardom. Easy-peasy, right?

However, Tu writes, “If a person grew up in a blue-collar family in Appalachia and moved to a mid-size city after school to work at Dunder Mifflin, what exactly is their path to, say, working at Google?”

Here’s a Singapore version of that: If you grew up in Woodlands and started working as an admin at a logistics firm in Tuas, while holding a polytechnic diploma, is the switch to a six-figure fintech job in the CBD really just a LinkedIn scroll away?

“Jobs aren’t just about paychecks,” Tu adds. “They’re cultural, they’re local, and they shape our identity.” Often, privilege plays a role in who gets the callback — not just effort.

🏠 Cliché #2: “Just find a cheaper place to live! Get roommates!”

In a market where BTO queues feel like a lottery and condo rents have skyrocketed to S$4,000+ for two-bedders, where exactly is this mythical cheaper place?

Tu says, “Even if you’re renting, higher overall prices for landlords mean higher rent payments for you.” Also, with home ownership being a long-standing wealth-builder, this “cheaper place” advice might be steering us away from actual financial security.

Plus, let’s be real — “Who’s to say I don’t already have roommates?” she writes. One in three young adults in the U.S. still lives with their parents. Here in Singapore, it’s more like 9 out of 10. No shame — just realism.

🥑Cliché #3: “Just cut out the lattes and avocado toast!”

Yes, the infamous brunch blame game.

Tu says: “Short-term small expenses aren’t keeping us from achieving our goals the way most financial gurus want you to think they are.”

In a world where an HDB flat now costs more than S$500,000 and education loans stretch over a decade, skipping your once-a-week roti prata won’t suddenly hand you a condo in Tanjong Pagar.

Instead, she points to inflation as the real enemy. “The problem comes when average prices go up faster than average wages are going up.” This would sound very familiar to many Singaporeans out there.

😌 Cliché #4: “Just relax! Money can’t buy happiness!”

However, Vivian says, “False. So false. Falser than you even think.”

That old study about happiness plateauing at US$75,000 (S$101,000) is outdated! A newer 2021 study proves that happiness continues to rise with income — no cap, so yes, money can buy you joy, stability, and maybe an air fryer, among many other “happy” things, too.

Also, while your parents may have built wealth through steady jobs and affordable housing, Vivian reminds us: “Anyone born from the ’90s onward lived through collective trauma — economic and otherwise.”

From 9/11 to COVID-19 to bank collapses, Gen Z and Millennials have been financially waterboarded since day one. “What we’ve been taught about ‘how the market works’ does not match with our lived reality,” Vivian adds.

💡 So… “It’s okay to want to have money!”

If you’re feeling exhausted from trying to “do everything right” and still coming up short — you’re not lazy, entitled, or bad at money. You’re just operating in a system built for someone else’s reality.

“It’s okay to feel a little spooked and unsure, and it’s okay to want to have money,” Vivian Tu ensures. And that might be the most honest financial advice we’ve heard in a while.

So let’s retire the avocado toast scapegoat — and start thinking smarter.

Vivian Tu is the founder of Your Rich BFF, author of Rich AF, and a content creator with millions of followers across TikTok, YouTube, LinkedIn, and Instagram

The original version of I became a millionaire at age 27—these common money tips ‘need to die because they are keeping us broke by Vivian Tu was first published in CNBC Make it